Proactive Financial Fraud Detection using Generative AI

By: Harshitha N (Travel Development Department)

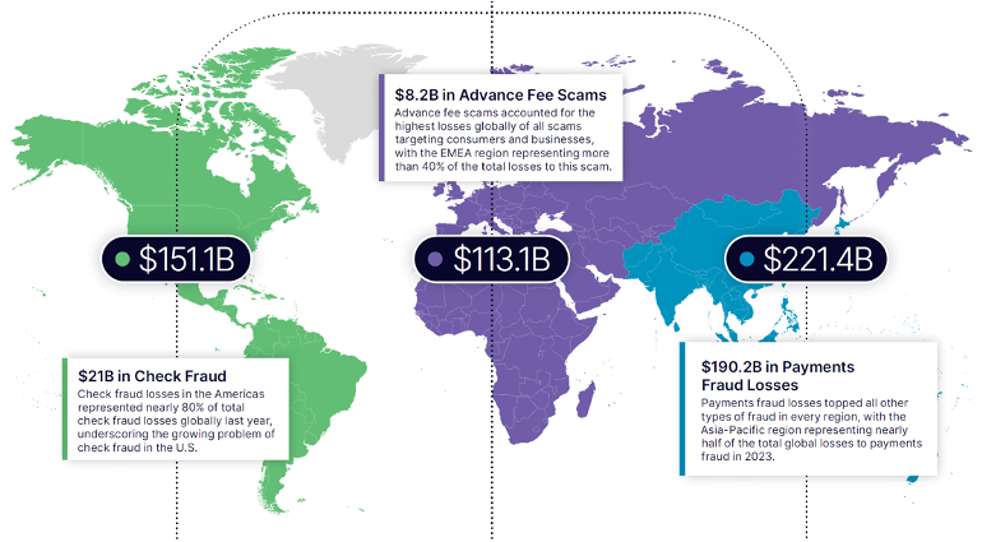

The fintech sector has witnessed remarkable technology advancements that facilitate the easy assimilation of digital financial services into our everyday existence. However, as technology advances, so do the methods used by fraudsters and threat to financial security is prevalent. The 2024 Global Financial Crime Report found that more than $3.1 trillion in illicit funds flowed through the global financial system in 2023 alone. The report also reveals that losses from fraud scams and bank fraud schemes accounted for nearly $485 billion globally in 2023.

Manipulation of financial information indicators refers to the use of technology and digital tools to commit fraudulent activities in the financial industry. This can include activities such as hacking into financial systems or manipulating financial data to deceive investors or regulators.

Most Common Types of Financial Frauds

Identity Theft occurs when a criminal steals your personal information and uses it to impersonate you, looking to steal your money, data and other personal assets.

Phishing is a type of fraud where criminals send fake emails or text messages that appear to be from legitimate companies or organizations in an attempt to trick you into providing personal information.

Investment Scams involve fraudulent investments that promise high returns with little or no risk. These scams often target the elderly or inexperienced investors who are looking for ways to make quick money.

Credit Card Fraud occurs when someone steals your credit card information and uses it to make unauthorized purchases.

Ponzi Schemes Schemes are fraudulent investment schemes that promise high returns to investors, but instead use new investors' money to pay off earlier investors.

Evolution of Fraud Detection Technologies & Tools

Fraud detection technology has evolved over years, each improving on the advantages and resolving the drawbacks of the one before it. They've moved beyond traditional methods, embracing technology's potential.

1994 -2010:

The fraud detection journey began with simple rules-based engines. Here, several if-this-then-that types of rules were hard-coded to detect previously seen fraud patterns. These systems used predefined guidelines to detect threats but struggled with complexity and required frequent updates.

2010-2023:

The second generation of fraud prevention technologies evolved to apply traditional ML models and rules. By doing so, systems were able to detect known types of fraud. The upside of this is that it can deal with high-dimensional data. The downside is that it requires a lot of training data, which can sometimes take months to acquire. However, these methods faced challenges such as reliance on large datasets and high deployment costs.

Emergence of Generative AI:

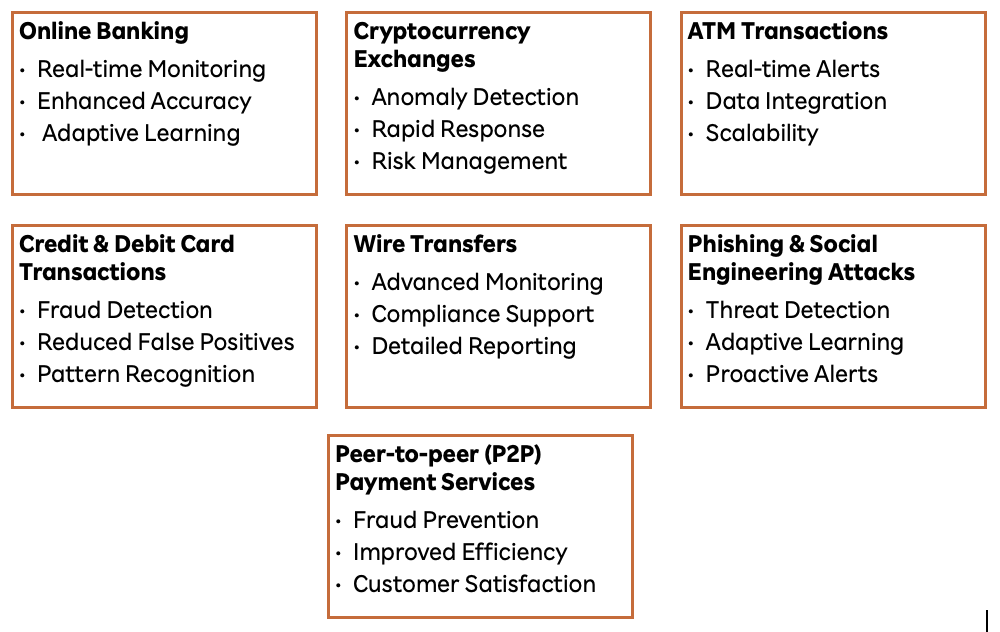

Fraud detection has seen an increase in the use of Gen AI recently. It generates synthetic data, which is necessary to build intricate models. Its potential for businesses is considerable, even though fraudsters have abused it. The most recent developments in this area include natural language processing, behavioral and device biometrics, and predictive analytics, which provide more advanced techniques to spot and stop dishonesty.

Benefits of Generative AI for Financial Fraud Detection

Gen AI has emerged as a crucial weapon for identifying and stopping fraudulent activity, providing several benefits and tools that more conventional approaches did not. Its use is characterized by complex algorithms, data augmentation, and adaptive learning, which result in notable increases in accuracy and decreases in false positives. Some of the benefits are as follows.

Features of Generative AI for Financial Fraud Detection

Real-Time Analysis and Proactive Anomaly Detection

Large-scale real-time dataset examination is a strong suit for generative AI. In sectors where there are a lot of transactions, like finance and eCommerce, this skill is essential. Artificial intelligence can warn or restrict questionable financial activity in real time by rapidly digesting this data, potentially averting financial loss. Based on past data, it can identify "normal" behavior and quickly highlight deviations from the norm. Compared to earlier systems, this strategy is significantly more effective.

Adaptive Learning

Generative AI systems are capable of learning from the data they process, in contrast to traditional systems that depend on static rules and models. When new forms of fraud appear, they could adapt and detect them, frequently without the need for human intervention. Being flexible is essential to avoiding fraudsters who are always changing their strategies.

Data Augmentation and Improved ML

Generative AI works effectively for building synthetic datasets based on real data. This ability can be beneficial in fraud detection, as there are frequently few good scenarios available, which makes it difficult for ML models to learn effectively. Gen AI increases the attention signal for key detection tools by creating artificial samples that mimic real-world situations. By adding resilience to the deception model, this strategy helps it identify similar attacks as well as patterns that traditional methods might overlook.

Striving Against AI-Enabled Fraud

As fraudsters can also create synthetic identities, deepfakes, and misleading information using Gen AI, organizations need to be on the lookout for threats and adjust their security protocols accordingly. Data patterns and potential risk indicators are identified through the analysis of data using Generative AI for fraud detection and prevention. By using this strategy, businesses may identify potential fraudulent activity early on and expedite the creation and testing of new detection models.

Real World Usage of Generative AI in Fraud detection

PayPal uses GenAI to ensure transactional security, leading to an 11% reduction in losses. It utilizes machine learning algorithms to analyze transaction patterns, detect anomalies, and flag potentially fraudulent activities. By monitoring millions of transactions simultaneously, PayPal's fraud detection system can identify and block fraudulent transactions within milliseconds, protecting both the company and its customers from financial harm.

Visa’s Visa Account Attack Intelligence Score uses generative AI to analyse transaction data in real time, achieving an 85% reduction in false positives compared to other models, for example. This advanced system enhances risk assessment for card-not-present transactions, improves decision-making for card issuers, and boosts consumer satisfaction while mitigating financial losses.

Mastercard’s deployment of generative AI has improved its fraud detection capabilities, achieving a twofold increase in the speed of identifying compromised cards and a 300% boost in the identification speed of at-risk merchants.

Key Takeaways

- Generative AI transforms the field of fraud detection with its capability for large-scale data handling, enhanced anomaly detection, decreased false positive rate, and adaptable learning.

- Enhancing contextual knowledge, fraud pattern analysis, and adaptability in fraud detection is possible when Generative AI and Machine Learning are combined.

- As the digital world continues to evolve, the battle against fraud must evolve with it. Generative AI in FinTech has endless opportunities. Fintech companies need to leverage the full potential of Generative AI to stay ahead of the competition and offer an impeccable customer experience.

If you found this post on fraud detection in Fintech business insightful, be sure to check out our other blog on Advertising fraud detection

Harshitha N | RIEPL

August 20, 2024